Nippon Steel Raises Prices of Sheet Piles by 5,000 Yen from Apr

= It has decided them due to large rises in costs of logistic and labor =

Nippon Steel of Japan raises its domestic prices of steel sheet piles by 5,000 yen per ton from April. The company also raises lower prices of steel pipe piles. It has already made offers to customers to set extras of both items depending on a burden of transportation.

The Government’s firm projects of public works related to ‘the 5-year National Resilience Acceleration Measure’ and construction works related to the Ministry of Defense of Japan are expected to be on budget. In addition, firm civil engineering demand for around 170 thousand tons of sheet piles and around 290 thousand tons of pipe piles are with redevelopment projects in the Metropolitan Area and factory construction projects starting with for semiconductors imminent are expected in the year 2024 ending March 31, 2025 as with those of the year 2023.

While, as a result that the company coped with an improvement in prices in the year 2022, prices recovered to a certain level. However, even at present, the company is unable to secure appropriate margins to meet costs.

Costs of logistics and labor as well as prices of raw materials and fuels are soaring. Under such circumstances, the company has decided to raise its domestic price of sheet piles by 5,000 yen and lower prices of pipe piles.

Compared to other steel products, civil engineering steel products are delivered to a project site customers (including galvanized steel coils), and therefore, efficiency of loading is worse than other products including logistics and labor. So, the company intends to set extras between 1,000-3,000 yen per ton depending on a burden. As for deliveries to remote areas, the company sets a new extra for sheet piles an revises the existing extra for pipe piles within the range of 5,000 yen to 20,000 yen per ton.

- See more: Top galvanized steel suppliers in Vietnam

Stelco Reports Substantial Falls in Revenue, Incomes for FY2023

= From the 4th quarter, prices of steel products again fell =

According to the consolidated financial results in the fscal year 2023 released on 21st by Stelco Holdings of Canada, its revenue was C$2,917 million (US$2,162 million at $1=C$1.35), down 15.8% from the previous year. Its operating income was C$309 million ($229 million), down 71.5% ditto,

and its adjusted net income was C$218 million, down 73.4% ditto.

Compared to those of the previous year, both of its revenue and income fell largely. The company reported a net loss in the 1st quarter and a net income in the 2nd and the 3rd quarter each with a recovery in performance. However, du to an impact again on a fall in steel products (such as galvanised steel coil…) ( in the 4th quarter, the company was forced to record a defcit of its operating and net income each.

Its shipments of steel products in the FY2023 were 2,618 thousand tons, down 0.3% being almost fat from the previous year. While, its average sales price was C$1,051, largely down 16.7% or C$210 ditto, which led to falls in its revenue and income.

Russia’s Mechel Reports Falls in Revenue, Proft for FY2023

= The mining segment was in a slump while the steel segment supported its

performance =

According to the consolidated fnancial results for the fscal year 2023 (January-December 2023) released on 21st by Mechel of a Russian leading steel manufacturer, its revenue was 405.9 billion rubles (US$4,397 million at $1=95.42 rubles), down 6.5% from the previous year, its operating proft was 64.8 billion ($702 million), down 33.4% ditto, its EBITDA were 86.3 billion rubles ($935 million), down 25.0% ditto, and its EBITDA margin was 21%, down 6% ditto.

In the first half of the year, both of its production and sales of coal fell due to a lack of a capacity of railway infrastructure in east of that country, and in addition, due to the depreciated ruble, the company was forced to record a defcit. In the second half of the year as well, at the Korshunov Open Pit, a malfunction of water sprinkling occurred. Accordingly, mining was suspende temporarily. Partly due to it, its performance of the mining segment was worsened through the year.

Its EBITDA at that segment for the FY2023 were 37.2 billion rubles ($402 million), down 49% from the previous year.

While, at its steel segment for the FY2023, despite of falls in sales and production quantities due to the periodic maintenance of a blast furnace, helped by a decrease in costs of raw materials and a rise in prices of steel products (like: galvanized steel coils, galvalume steel coils…) in the second half of the year, its EBIDA were 47.3 billion rubles ($512 million), up 32% from the previous year.

Russian Mechel’s Steel Production Falls by 2% to 3,490 t/t in 2023

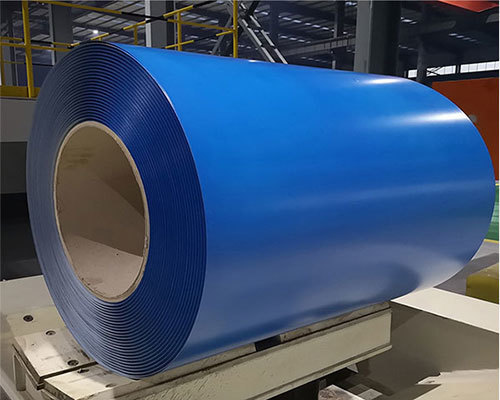

If you are looking for good quality coated steel sheet in coils (GI, GL, PPGI, PPGL) and HRC steel from leading steel manufacturers from Vietnam, kindly contact us at:

Bài viết liên quan

Steel Market Updates April 2024 – by GTS Steel

Global HR Coil Steel Prices Take a Nosedive, Landing at $558 In the latest assessment

Top Leading Steel Manufacturers in South Korea – GTS Steel

Top Largest Steel Mills in South Korea – GTS Steel South Korea emerged as a

Steel News 13 March 2024 – GTS Steel – Vietnam Steel Supplier

European HRC prices keep stable and see the buyer’s reaction – Updates from Steel Suppliers

Steel Market Updates On 12 March 2024 – by GTS Steel – Steel Supplier In Vietnam

European stainless steel coils price increases: According to sources cited by Kallanish, European prices for

Steel News – Market updates on March 2024

Steel Market Reacts Slowly to Baosteel’s Tinplate Price Rise Although Baoshan Iron and Steel (Baosteel)

Top 5 Galvanized Steel Manufacturers In Vietnam

Vietnam is one of the leading countries producing and exporting steel in the world (combine